Machine Learning | Artificial Intelligence : SOME CONCEPTS (this page is under construction...)

|

- Data Drift: Patterns change, shopping behaviors change, economies change, so there is a continuous need to update and upgrade the model, it's variables, need to be upgraded.

- Two types of Data: Primary Data - collected through regular business transactions

- Secondary Data:

- Binary Classifier: Test Data, Train Data, Validation Data

- Positive Prediction and It is a positive -> True Positive

- Negative Prediction and it is negative -> True Negative

- But model can make mistakes and predict a false positive and false negative.

- Accuracy= (True Positive + True Negatives)/Total Predictions

- Misclassification Rate = 100% - accuracy%

- What is the problem? The problem is all these algorithms give a probabilistic score and leave it upto us to decide whether to accept the risk or not. Example: 0.85 certainty that this transaction is a fraud.

- Sensitivity (healthcare) = True Positive Rate = Recall (memory based) -> how many positives compared to the actual positive were actually identified.

- Specificity = True Negative Rate = TN/Negatives

- There is always a trade off between Sensitivity and Specificity. The more sensitive you get the less specific results may get.

- F1Score=2/[(1/Recall)+(1/Precision)]

- So, a good model has high accuracy, high specificity, and high sensitivity.

- Important Questions to ask: what is the cost of false negative for the scenario or the cost of false positive.

- Dependent variable and independent variable.

- Expected value calculations and cost benefit analysis are critical to making a real business decision.

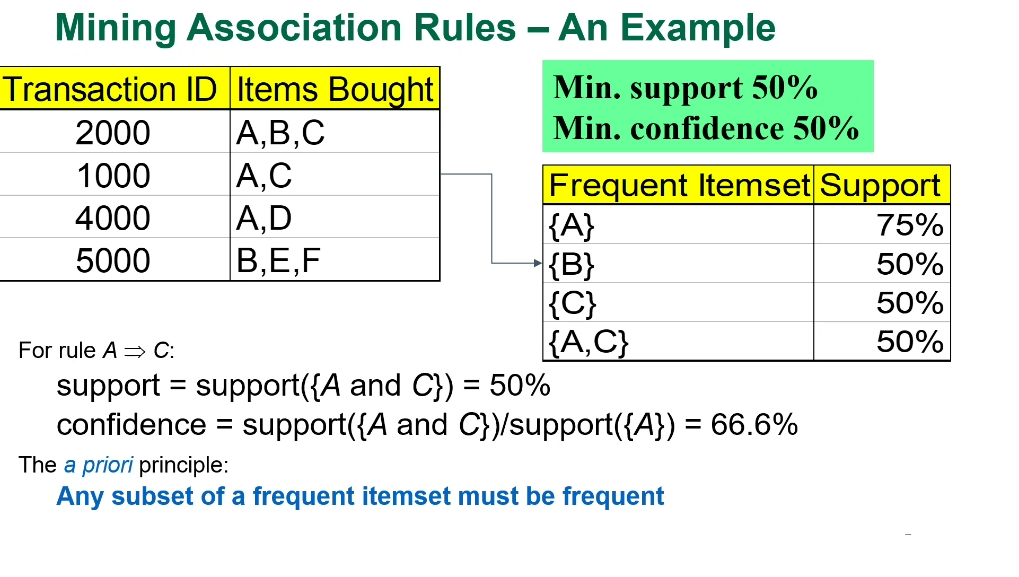

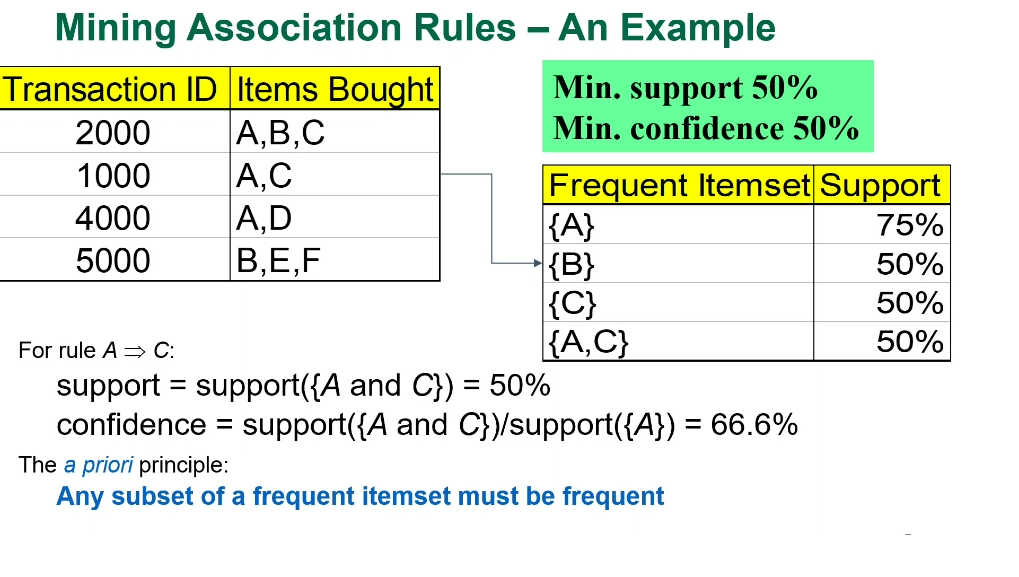

- MARKET BASKET ANALYSIS

- Bundling items together and suggesting the buyers on what items they should/can buy is the result of market basket analysis.

- Support and Confidence:

- Support for an Item A is 75% when it's in 3 out of 4 shopping carts.

- Confidence in a combination of items example A&C together:Support for (A&C)/Suport(A) or Support for (A&C)/Suport(C) meaning, every time a customer picks A, 66% of times he picks C and every time customer picks C, he always picks A =100% (based on given data) respectively.

- Rules:

- 1)

- 1) Associatie Rule:

-

| intelligent_cloud_computing.pdf | |

| File Size: | 344 kb |

| File Type: | |